All that SaaS; AI woes

Happy Friday! Goldman Sachs is likely to increase its stake in SaaS startup MoEngage. This and more in today’s ETtech Morning Dispatch.

Also in this letter:

■ TCS kicks off Q1 earnings season

■ Pine Labs, Swiggy valuation slashed

■ IAMAI on Karnataka gig workers’ bill

Wall Street major Goldman Sachs is in discussion to double down on enterprise software-as-a-service (SaaS) company MoEngage.

Deal details: The company will likely pump $35-50 million via a secondary transaction. Goldman will buy shares (of MoEngage) from some of the early investors.

“The contours are still being finalised, but there may be a discount to MoEngage’s last valuation for this Goldman investment,” a person in the know told us.

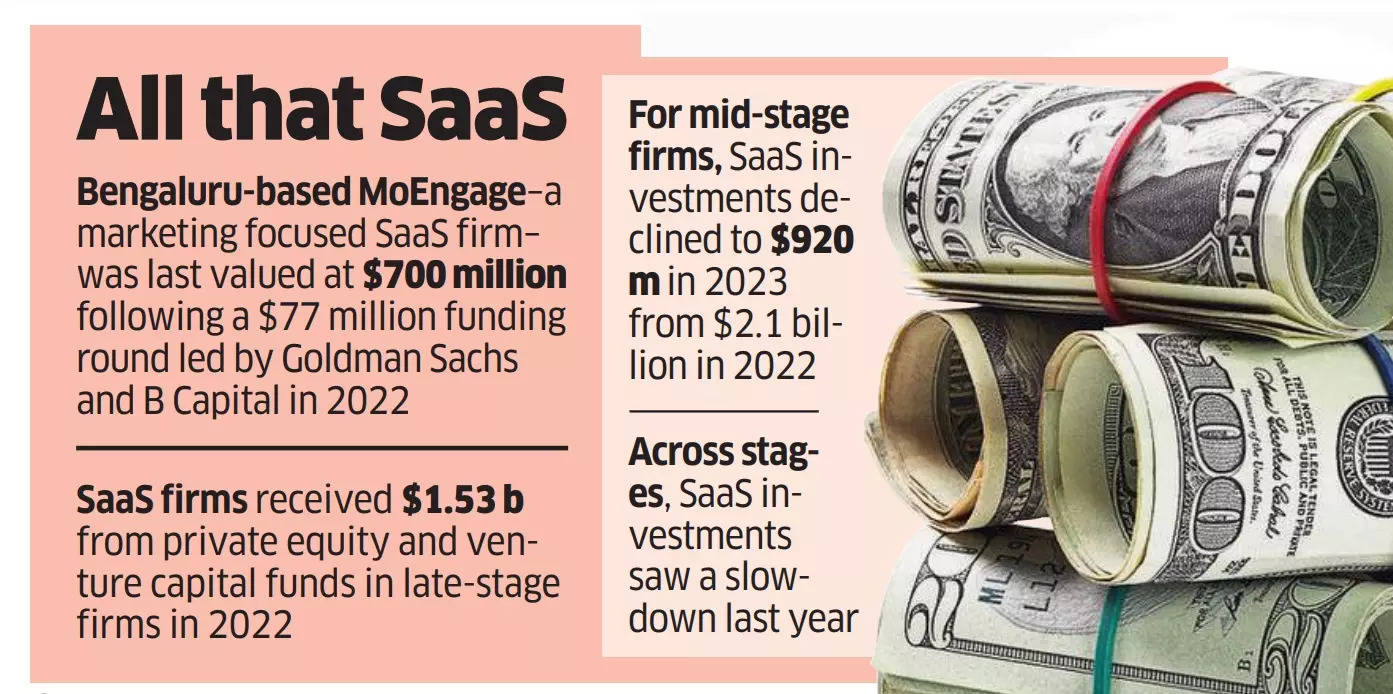

About MoEngage: The Bengaluru-based startup was last valued at $700 million in 2022. Started in 2014 by Raviteja Dodda and Yashwanth Kumar, MoEngage has raised a total of $182 million in funding since its inception.

Its investors include private equity firm Multiples, Matrix Partners India (renamed Z47), and Eight Roads Ventures.

SaaS gathers steam: The development comes amid increased deal activity in late-stage SaaS startups.

- World Bank arm, International Finance Corporation (IFC), made a disclosure saying it plans to invest $20 million in healthcare-focused SaaS firm Innovaccer

- Private equity firm Warburg Pincus is set to lead a $100-150-million funding round in SaaS firm Whatfix

- SoftBank is likely to invest more in Icertis

- Data collaboration software startup Atlan raised $105 million in fresh capital in May

Indian data centre operators are racing to reduce the massive power consumption of AI infrastructure with innovations like liquid cooling and energy storage solutions.

Go deeper:

- Digital Connexion, the Reliance-Brookfield-Digital Realty joint venture data centre operator, said it is using direct liquid-to-chip cooling, immersion cooling, and magnetic levitation air-cooled turbocor chillers, curbing energy consumption by up to 15%. Its Chennai data centre has no water dependency.

- ESDS Software Solutions uses automatic power factor control (APFC) panel provision, metering and monitoring for effective energy management.

- CtrlS Datacenters said it was investing in energy storage solutions to balance grid loads and maximise renewable energy utilisation.

Why is it significant: GPU servers consume 20 times more energy than CPUs and need more cooling in a tropical country like India, where indoor temperatures touch 29 degrees.

With the Indian government and private players set to acquire 100,000 GPUs by the end of 2024, Deloitte estimates the power consumption is set to rise by 300MW. This is a sharp increase from the existing installed capacity of 726MW of the entire industry, data from JLL Research showed.

Limited resources: The AI revolution has also raised concerns over water scarcity as data centres directly consume water for cooling purposes and indirectly through non-renewable electricity generation.

“India, with 18% of the world’s population but only 4% of its water resources, faces severe water stress,” said Vinit Mishra, partner, technology consulting, EY India.

TCS CEO K Krithivasan

Tata Consultancy Services (TCS) on Thursday reported a 8.7% year-on-year (YoY) growth in its June quarter net profit at Rs 12,040 crore.

Key numbers:

- TCS posted revenue growth of 5.4% to Rs 62,613 crore for the quarter

- It reported new deal wins of $8.3 billion in the June quarter

- Operating profit margin narrowed to 24.7%, largely because of the impact of wage hikes

- Profit after tax (PAT) was down 3% from Rs 12,502 crore in Q4 FY24

Dividend payout: The company also announced a Rs 10 per equity share interim dividend on Thursday and kept August 5 as the record date for the same.

TCS shares closed 0.33% up at Rs 3,922.7 apiece on the BSE.

Headcount up: After dropping for three consecutive years, the net employee count at India’s largest IT company grew by 5,452 during the first quarter of FY25. Total headcount as of June end stood at 606,998, up from 601,546 employees as of March end.

CEO speak: “We are continuing to expand our client relationships, create new capabilities in emerging technologies, and invest in innovation, including a new AI-focused TCS PacePort in France, an IoT lab in the US, and expanding our delivery centres in Latin America, Canada, and Europe,” K Krithivasan, chief executive officer and managing director, TCS, said.

On GenAI: On the AI front, Krithivasan said the overall opportunities being chased or the pipeline of deals has doubled to $1.5 billion, but added that most of the work is short-term, not exceeding one or two quarters.

Invesco reduces fair value of Pine Labs, Swiggy: US-based investor Invesco has reduced the fair value of fintech company Pine Labs and food delivery firm Swiggy in its books, according to its half-yearly shareholder report filed with the US Securities and Exchange Commission (SEC).

Karnataka’s proposed law for gig workers to impact business: IAMAI | The Internet and Mobile Association of India (IAMAI) has said the draft Karnataka Platform-based Gig Workers (Social Security and Welfare) Bill, 2024, recently introduced by the state government, could pose challenges with regard to the ease of doing business in the state.

Proptech startup Jugyah raises $1.5 million in funding: Proptech startup Jugyah has raised $1.5 million in a funding round led by White Venture Capital, QED Investors, and Godrej Properties. The round also saw participation from Whiteboard Capital, Singularity Ventures, and angel investors such as Cred founder Kunal Shah, Harsh Jain of Dream Sports, and Ramakant Sharma of Livspace.